At Iris® Powered by Generali, it’s not really about us. It’s about how identity theft and cybercrime have become a reality for too many. It’s about understanding that people lead busy lives and are doing their best to manage everything but need help protecting their data. It’s about making a person feel whole again, when despite their best efforts, they’ve still become a victim. It’s about understanding that many companies do what we do – just not like we do.

Iris is a B2B2C global care company that offers always-available identity resolution experts (yes, we mean real people available 24/7/365, even if you find yourself needing to make a call at 2 am or on New Year’s Day) and tech-forward solutions that uncomplicate the protection process. We opened our first Washington, DC office in 1982 with a simple mission, bringing customers from distress to relief – anytime, anywhere. It’s a calling we’ve held close to our hearts for decades now, and it’s made helping victims of identity theft and cybercrime feel like the most natural thing in the world for us. Although there was no business model to follow in launching such a service, we knew victims desperately needed an advocate to help them navigate a notoriously difficult process. That’s how we became one of the very first identity theft resolution providers in the U.S. in 2004 – and that was just the first of our “firsts.” Having the 190-year-old multinational insurance megahouse, Generali, behind us doesn’t hurt either.

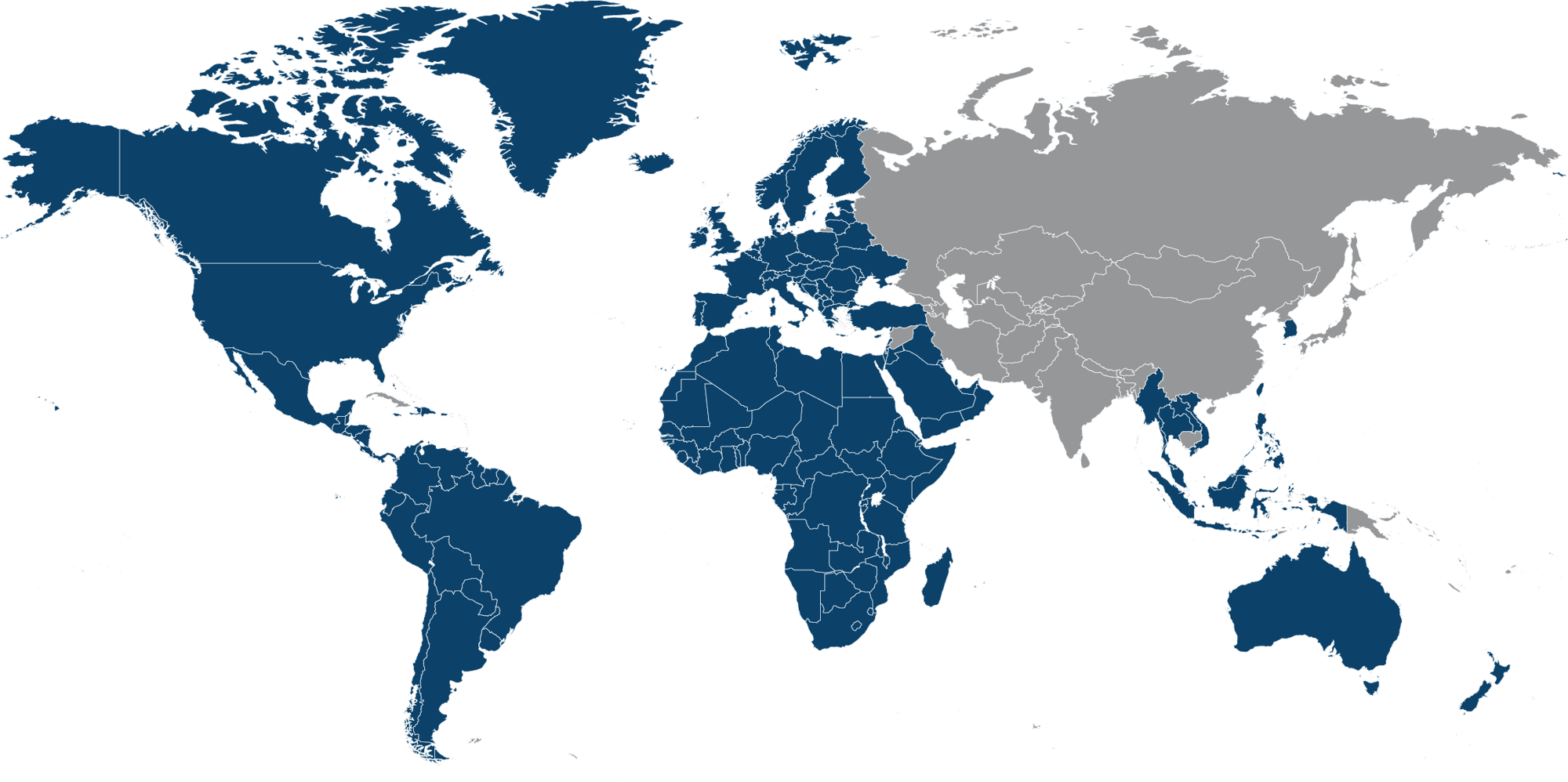

Today, our offering combines the world’s most caring, empathetic, expert assistance and support with the world’s most user-friendly and accessible identity protection technology. And whether your customers are in Brazil, Germany, or Vietnam, we know they’re still just trying to live life without worrying about their information getting into the wrong hands; that’s why we’ve got a solution no matter what your customers’ coordinates are. Ultimately, the most important thing to know about us is that we know it’s really not about us at all.

.png?width=102&height=102&name=Iris-Generali-Logo-White%20(1).png)