New from Iris!

Caller ID, Social Media, High-Risk Transaction, and Home Title

Additional Monitoring & Alerts

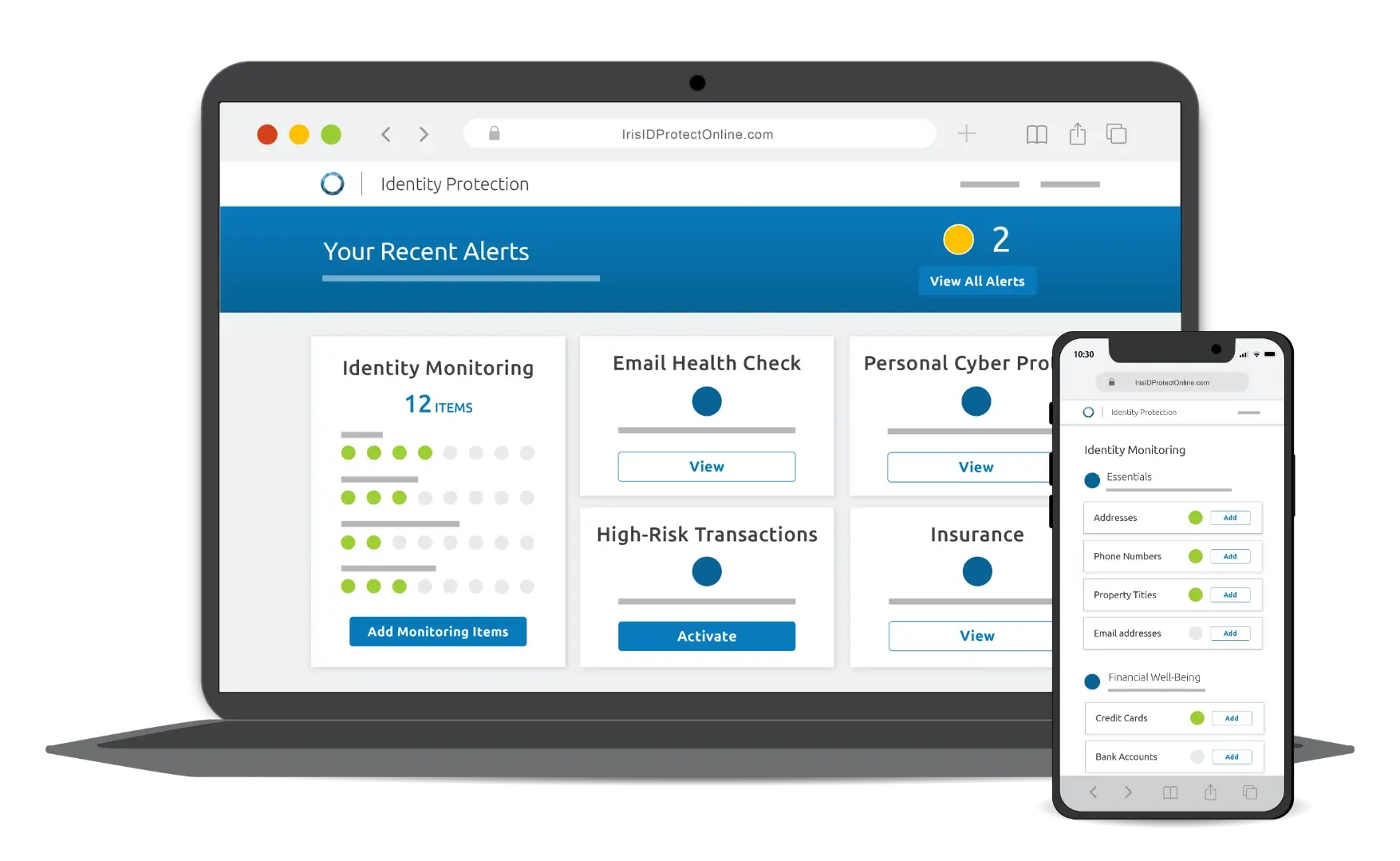

Today’s gateways to identity fraud are ever-expanding. Fortunately, Iris stays on top of these risks and is continuously adding to our monitoring capabilities – so you can ensure your customers stay ahead of potential threats.

Comprehensive Monitoring & Alerts

Iris offers an expanding suite of comprehensive monitoring and alert solutions.

Caller ID Monitoring & Alerts

Social Media Monitoring & Alerts

High-Risk Transaction Monitoring & Alerts

Home Title Monitoring & Alerts

Wealth Data

Monitoring

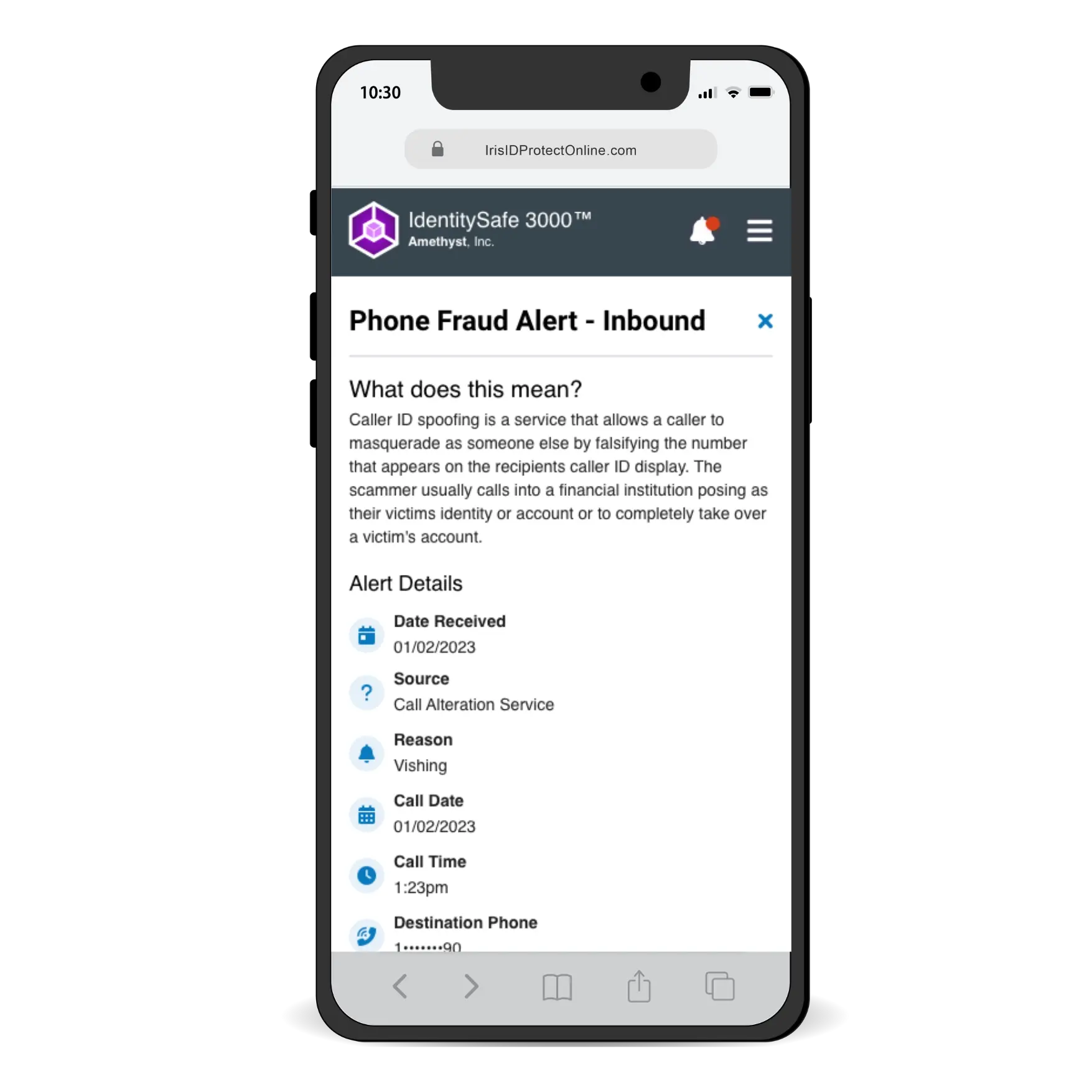

Caller ID Monitoring & Alerts

We alert your customers when we detect:

|

A Spoofed Incoming Call This occurs when a criminal contacts your customer using a false number to impersonate an organization, institution, or other legitimate entity, usually in a vishing attempt to solicit sensitive information. |

| A Spoofed Outgoing Call This occurs when a criminal uses your customer’s phone number to impersonate them when contacting others (called spoofing) – usually to gain access to their accounts, etc. |

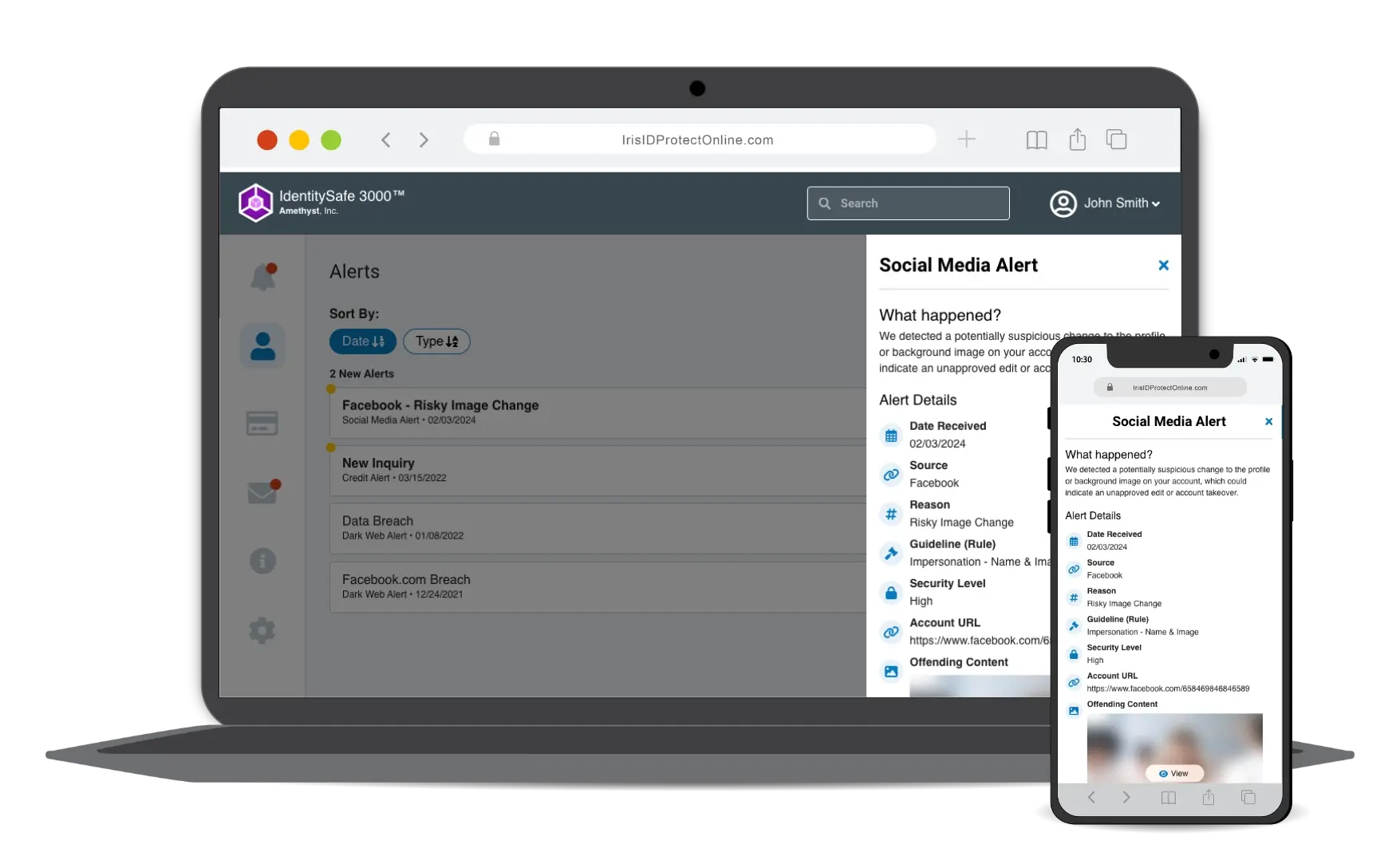

Social Media Monitoring & Alerts

Scammers and fraudsters are increasingly turning to social media to get the information they need to commit a crime, and parents are concerned about their children’s vulnerability to cyberbullying, violence, cyber predators, and more. Iris social media monitoring includes alerts for:

| Account Takeover Indicators in Social Posts, such as:

|

|

|

Inappropriate or Malicious Content, such as:

|

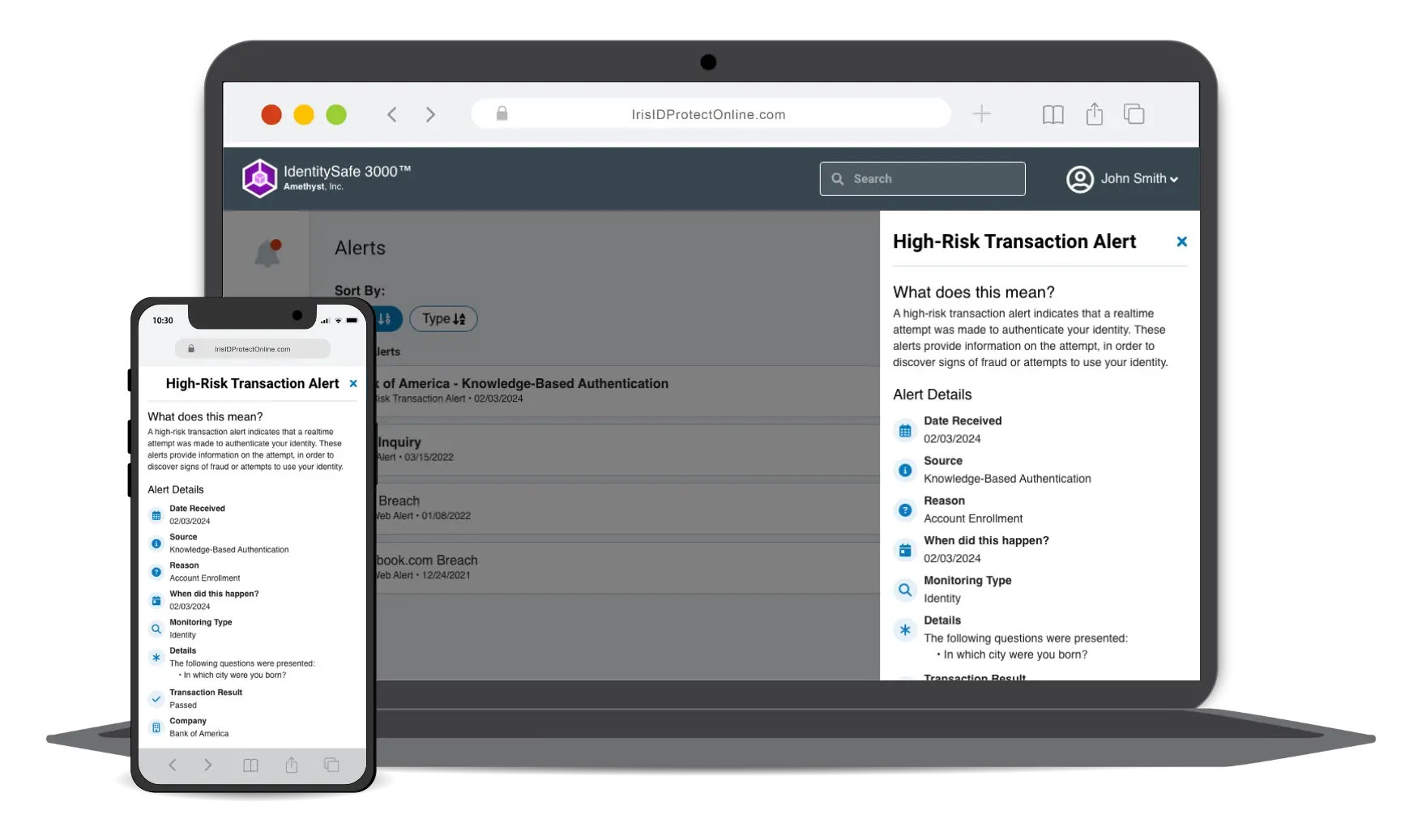

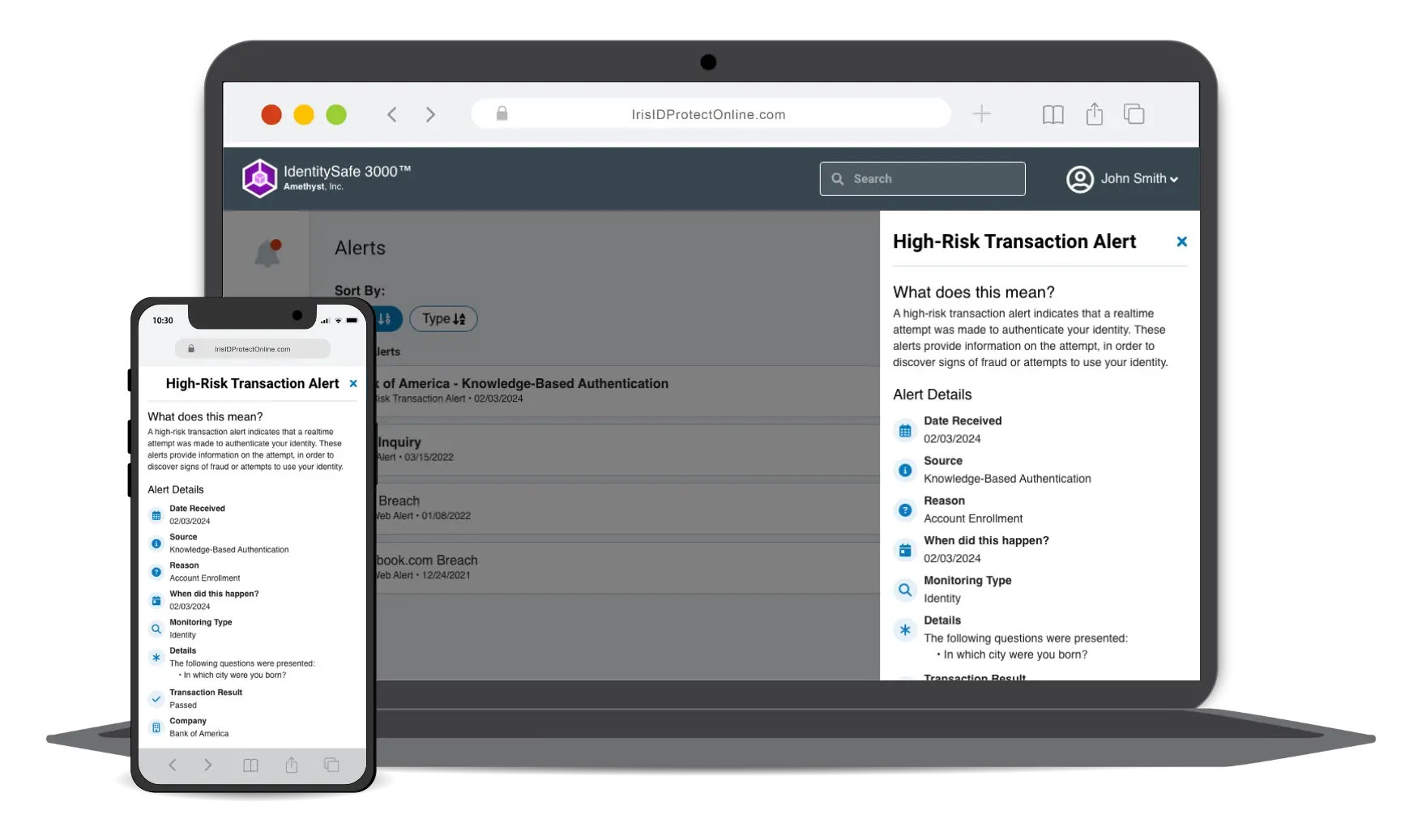

High-Risk Transaction Monitoring & Alerts

High-risk transaction monitoring lets customers know when someone is trying to identify as them in scenarios such as signing up for new accounts, signing into online accounts, or calling customer service. We generate alerts based on three types of verification:

|

Knowledge-Based Authentication |

|

One-Time Passwords |

|

Document Authentication |

Home Title Monitoring & Alerts

We continuously monitor property titles and send alerts when we spot changes. Fraudsters can use your customer’s stolen property to:

|

Forge Deeds |

|

Refinance Mortgages |

|

Fraudulent HELOCs |

|

Withdraw Equity |

Wealth Data Monitoring

Our premier personal financial data monitoring and identity protection package fosters your clients' financial wellness by safeguarding them against fraud. Fraudsters can exploit stolen financial data from your clients to:

|

Sell on the Dark Web |

|

Takeover Accounts |

|

Rent or Purchase Property |

|

Commit Identity Theft/Fraud |

Interested in Expanding Your Monitoring & Alerts Capabilities?

Going beyond standard dark web monitoring and alerts provides more comprehensive identity protection for your customers - and helps you stay competitive.

.png?width=102&height=102&name=Iris-Generali-Logo-White%20(1).png)