Wealth Data Monitoring

from Iris® Powered by Generali

The premier personal financial data monitoring and identity protection package.

A value-added benefit that strengthens loyalty and retention.

Secure Your Clients’ Financial

Information from Hackers

Securing your clients’ financial assets is already part of your mission. What about offering services to help protect their financial data?

|

The affluent are 43% more likely to experience identity theft.1 |

|

38% of victims closed their accounts due to inadequate resolution at their financial institution where the fraud occurred.2 |

|

Consumers spent an average of 10 hours resolving fraud in 2023. In 2022, the average was 6 hours.3 |

Fraudsters will use your clients’ stolen financial data to:

Sell on the

Dark Web

Takeover

Accounts

Rent or Purchase Property

Commit Identity Theft/Fraud

Unlock New Revenue Streams

with Identity Protection

Iris’ premier package will help you fortify client trust, strengthen retention and loyalty, and increase your firm’s revenue. Our clients generate millions of dollars in additional annual revenue after adding Iris’ identity protection program to their portfolio.

Provide Exceptional Protection

as Part of Your Financial Planning Program

With world-class protection services, award-winning fraud resolution support, strategic account management,

and ongoing partner marketing assistance, Iris allows you to deliver high-quality services via our

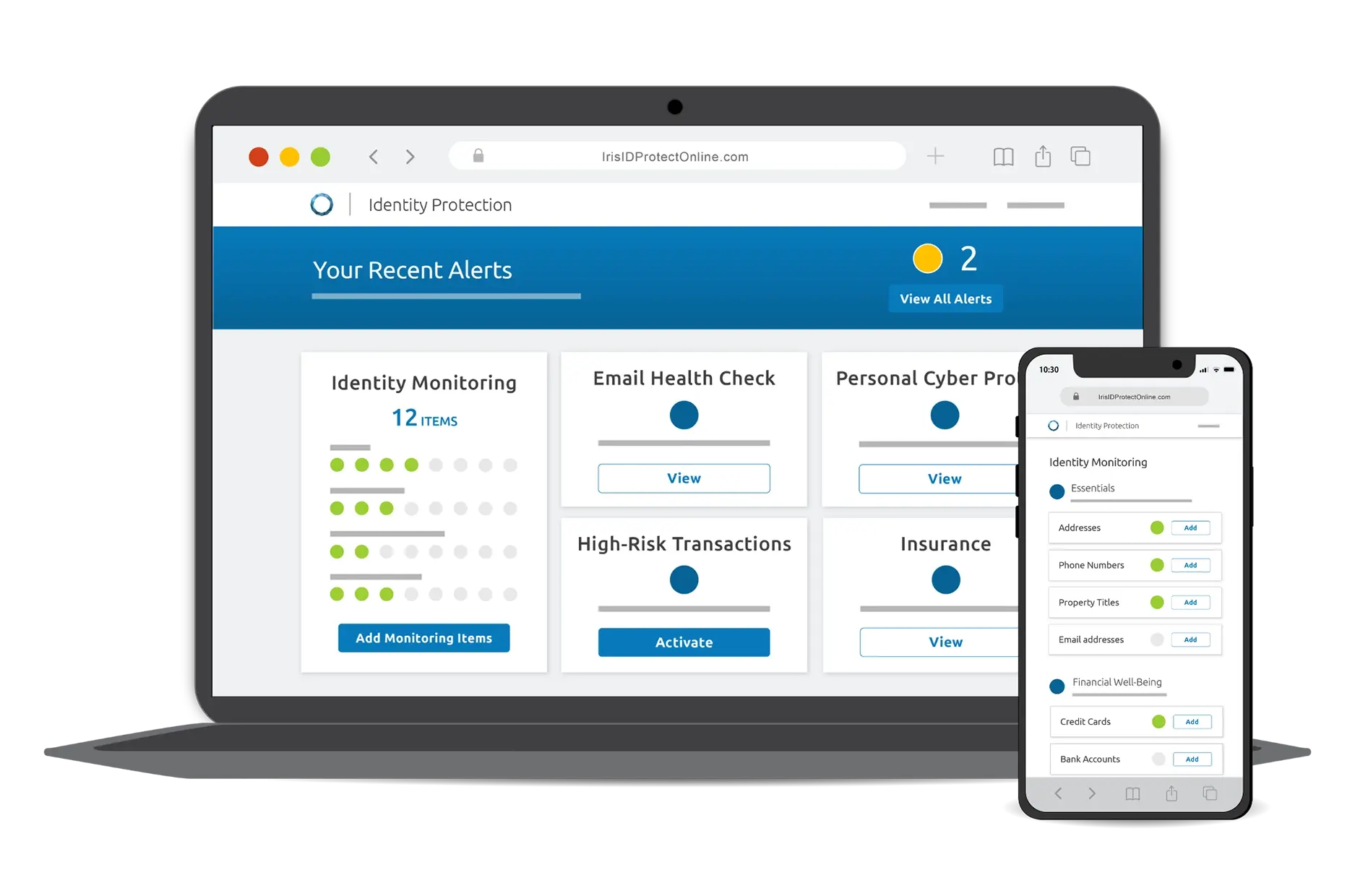

OnWatch® portal or APIs – helping to protect your clients’ wealth and increase your firm’s revenue.

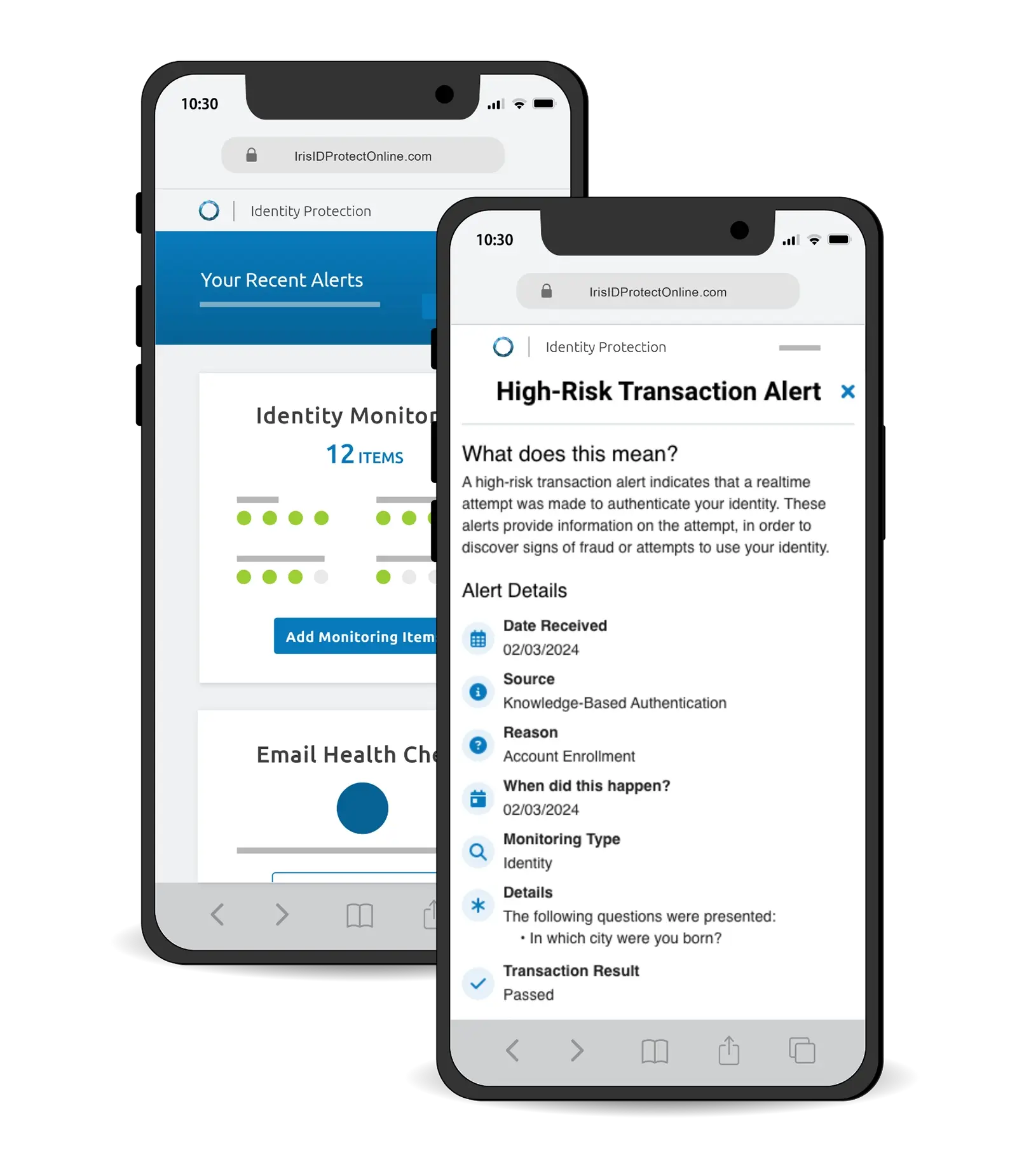

Identity Monitoring & Alerts

Credit Monitoring & Alerts

High-Risk Transaction Monitoring

ScamAssist®

Monthly Risk Report

24/7/365 Resolution Services

Up to $3 Million Identity Fraud Insurance

Help protect your clients against costly financial expenses associated with the resolution and restoration of a stolen identity with up to $3 million in identity theft expense reimbursement.***

World-Class Security from Iris

As a wealth manager, you know data security is of the utmost importance. Your clients’ trust in your firm to manage their data is non-negotiable. Concerned about data security via a third-party partner? Iris meets the highest standards set by the payment card industry. Security is ingrained into every level of our organization, making it one less detail for your firm and your clients to worry about.

1. Silicon Valley Bank, High Profile? High Net-Worth? You’re at Special Risk for Fraud, 2020

2. Javelin Strategy & Research, Identity Fraud Study, 2021

3. Javelin Strategy & Research, Identity Fraud Study, 2024

*Iris® Powered by Generali is not responsible or liable for the availability, safety, accuracy, or effectiveness of the techniques, products, tools, or resources used by Iris Powered by Generali in its ScamAssist® service and customers’ access and use of ScamAssist is entirely at their own risk.

**Localized support based on partners’ region. For example, U.S. partners’ customers have access to U.S.-based Resolution Specialists.

***Iris offers a variety of Identity Fraud Insurance plans. All plans include up to $1 Million in Identity Fraud Expense Reimbursement and Cash Recovery for unauthorized electronic fund transfers from Checking & Savings Accounts or Investment/Health Savings Accounts. Iris also offers an option for upgraded Identity Fraud Insurance with up to $2 Million coverage, Home Title Identity Theft Expense Reimbursement, and Cyber Extortion Expense Reimbursement.

Identity Fraud - Expense Reimbursement, Cash Recovery Aggregate, and Investment & HSA Cash Recovery benefits are underwritten and administered by American Bankers Insurance Company of Florida, an Assurant® company, under group or blanket policies issued to Iris® Powered by Generali for the benefit of its Members. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits at https://www.irisidentityprotection.com/terms-conditions.

Take Your Offering to the Next Level

Ready to enhance your wealth monitoring offering with Iris’ comprehensive wealth management protection? Contact us today to learn how we can help you protect your clients’ assets and identities while growing your revenue streams.

.png?width=102&height=102&name=Iris-Generali-Logo-White%20(1).png)