Senior Identity Protection & Beneficiary Assistance

from Iris® Powered by Generali

As a trusted provider of senior services and assistance, you can provide your mature audience proactive defenses against financial fraud, scams, social media account takeovers, and even support for their beneficiaries.

Empower Seniors

with Exceptional Protection

In today’s hyper-digital world, where technological advancements are accelerating at an unprecedented rate, scams and identity fraud tactics are becoming increasingly difficult to discern. And seniors are among those targeted most. Unfortunately, simply advising seniors to be cautious isn’t enough – modern threats require modern solutions.

The risks are real:

| Over $1.5 billion is lost annually by seniors (those 60-80+ years old) to fraud and identity theft.1 | |

| The average loss per individual senior to fraud, scams, and identity theft-related crime is a whopping $29,087.2 | |

|

According to the FBI, the most common frauds affecting individuals over 60 years old include:3

|

Your business is built on trust, and your senior community, members, and clients rely on you to protect their future. Partner with Iris to differentiate your brand and help secure their legacy.

Modern Protection for the Most Vulnerable

Senior Identity Protection & Beneficiary Assistance

Save seniors from emotional distress and differentiate your business with value-added protection benefits. This protection package is designed to enhance:

| Senior Living Communities | |

| Financial Planning & Services | |

| Medicare Supplement Bundles | |

| Insurance Offerings | |

| And Many Others! |

Let Iris Help You Exceed Expectations

While you empower your older audience with modern technology and 24/7/365 compassionate fraud support, we empower you with direct access to account personnel, ongoing strategic partner marketing, and an efficient go-to-market set-up. Our seasoned team will have your branded, web-based portal customer-ready in 30 days or less.

Our fraud resolution center has won 20+ customer service excellence awards, maintaining high overall satisfaction and an average Net Promoter Score of 87. We get hundreds of compliments a month, routinely exceeding expectations.

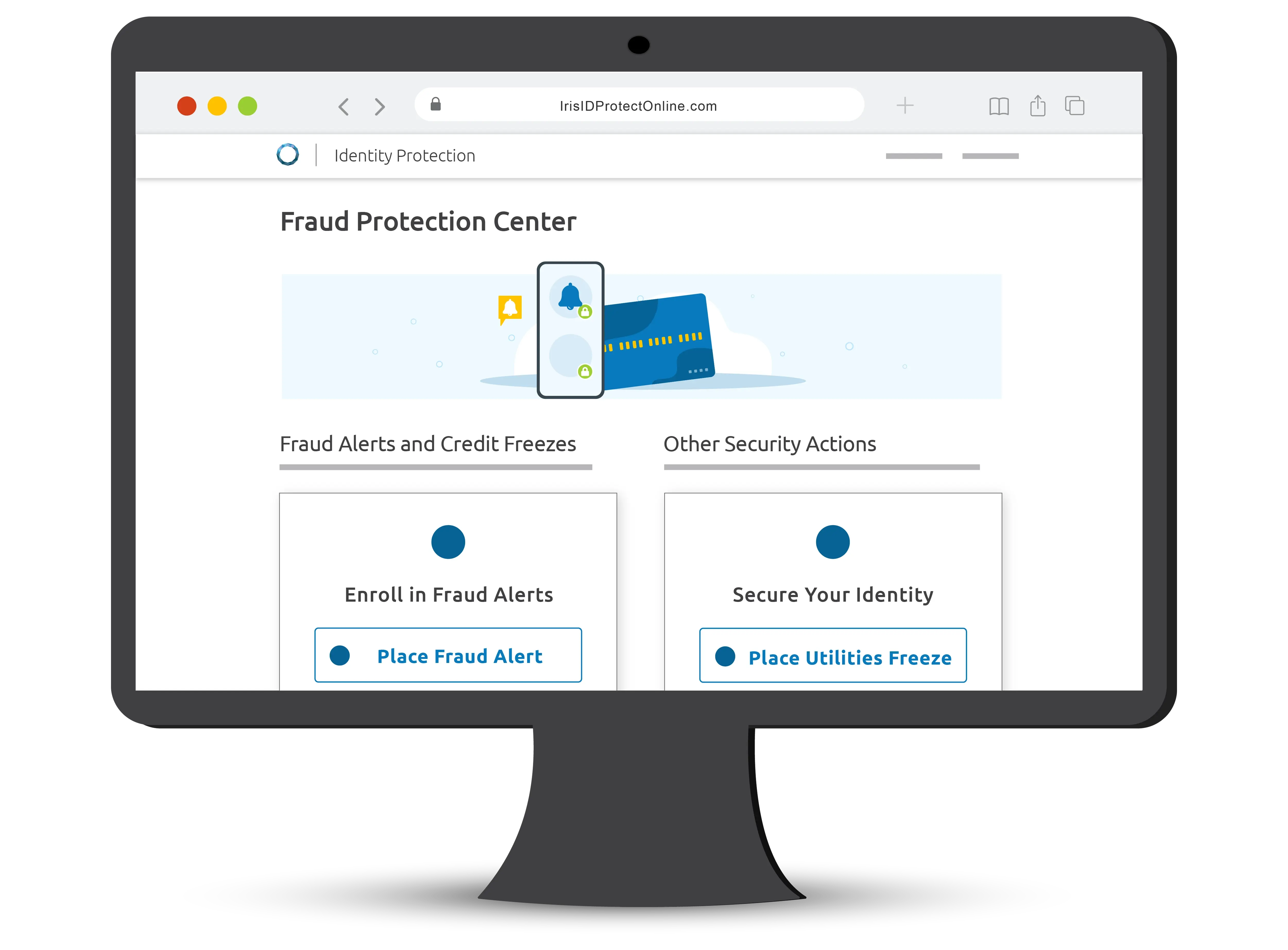

Provide Your Clients Robust Protection

That Helps Safeguard Their Wealth, Tech, and Well-Being

Let Iris help you offer a better experience and more security to protect what matters most to seniors and their family. Whether you choose to offer our premium plan, standard plan, or both, we have the right services and technology to meet your audiences’ needs.

Partner with Iris to provide real protection, real support, and real peace of mind for the people who need it most.

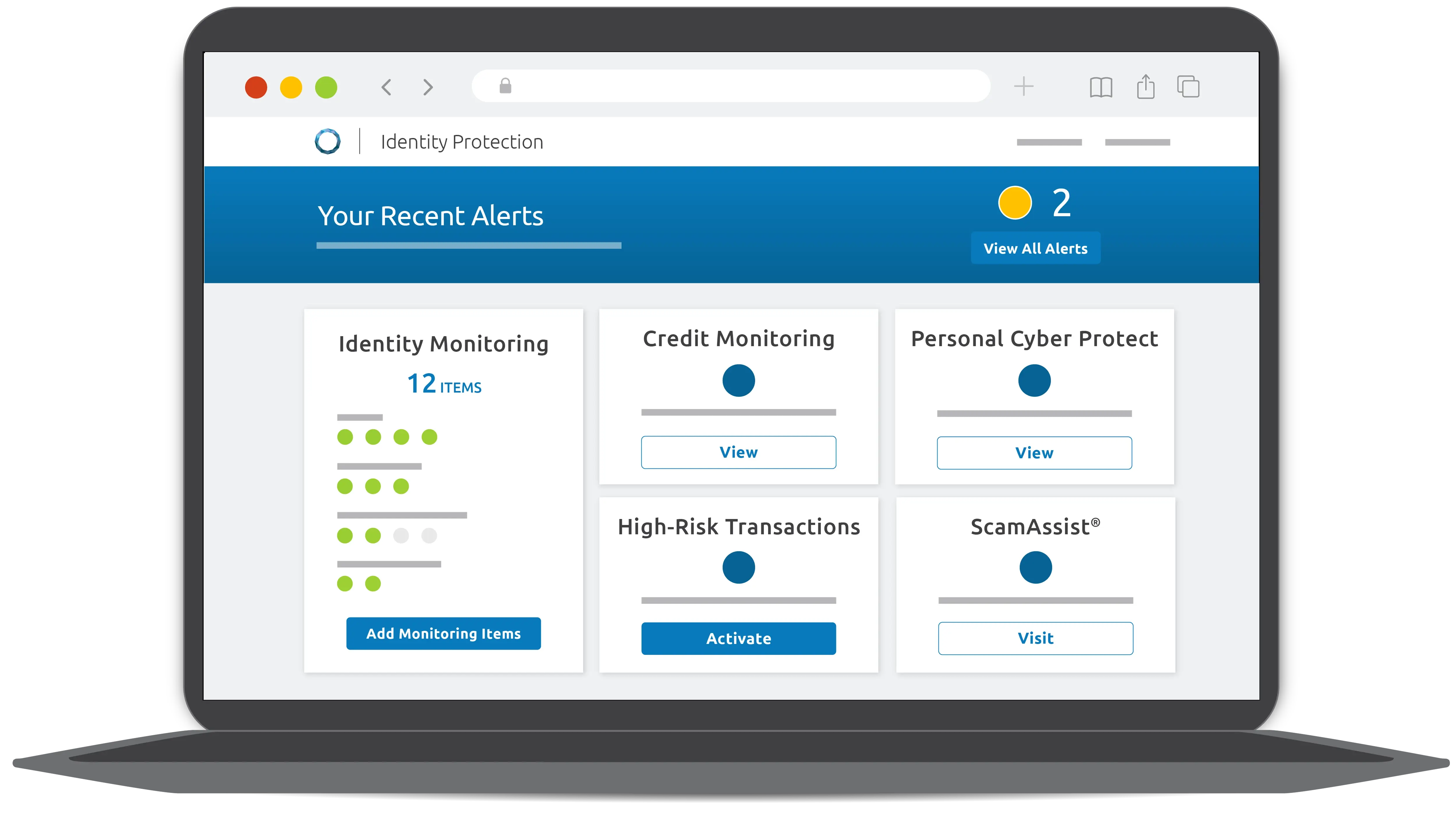

Identity Monitoring & Alerts

Caller ID Monitoring & Alerts

High-Risk Transaction Monitoring

Social Media Monitoring & Alerts

Customer Account Summary

ScamAssist®

24/7/365 Resolution Services

Personal Cyber Protection

Beneficiary Companion®

With Iris’ Beneficiary Companion®, your clients’ beneficiary receives a dedicated beneficiary assistance coordinator who will handle the multitude of administrative details like time-consuming phone calls and stressful paperwork. Their dedicated coordinator is also available 24/7 to put measures in place to help prevent fraud of their deceased loved one’s identity.

Credit Monitoring (1B Monitoring) & Alerts

Your customers can access their credit report and score and receive detailed notifications of changes to their credit profile, such as new credit inquiries or accounts, which could indicate fraudulent activity

Included in Iris’ premium plan.

Home Title Monitoring & Alerts

Seniors can protect themselves against home title fraud with Iris’ home title monitoring that provides continuous monitoring of their property titles. Seniors can receive alerts when we detect suspicious activity or changes to title ownership, lender, or financing, ensuring their properties remain secure.

Included in Iris’ premium plan.

Up to $2 Million Home Title Identity Theft Expense Reimbursement

Your clients can be protected against costly financial expenses associated with the resolution and restoration of a stolen identity and home title identity theft expenses with up to $2 million home title identity theft expense reimbursement.**

Included in Iris’ premium plan.

Protecting Identities Across Generations

Iris® Powered by Generali is a B2B2C global identity and cyber protection company owned by the 190-year-old multinational insurance company, Generali. We first opened our doors with a simple mission, to bring customers from distress to relief – anytime, anywhere – and went on to become one of the very first identity theft resolution providers in the U.S. in 2004. Today, we partner with some of the world’s most well-known brands, protecting their people how they want to be protected, no matter where they are.

Leveraging over 20 years of experience with more than a quarter of our user audience 60 years or older, we understand the importance of keeping the most vulnerable safe and secure.***

1. Federal Trade Commission, Consumer Sentinel Network Data Book, 2022 – 2024

2. Federal Bureau of Investigation, Elder Fraud Report, 2021-2023

3. ID Analytics

**Iris® Powered by Generali is not responsible or liable for the availability, safety, accuracy, or effectiveness of the techniques, products, tools, or resources used by Iris Powered by Generali in its ScamAssist® service and customers’ access and use of ScamAssist is entirely at their own risk.

**Identity Fraud - Expense Reimbursement, Cash Recovery Aggregate, and Investment & HSA Cash Recovery benefits are underwritten and administered by American Bankers Insurance Company of Florida, an Assurant® company, under group or blanket policies issued to Iris® Powered by Generali for the benefit of its Members. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits at https://www.irisidentityprotection.com/terms-conditions.

*** This percentage does not fully capture Iris Powered by Generali’s entire user audience, as not all of our OnWatch® portal users have shared their date of birth.

.png?width=102&height=102&name=Iris-Generali-Logo-White%20(1).png)