Insurance ReimaginedA World of Possibilities with Iris® Identity Protection

Provide your policyholders with a highly personalized experience that perfectly complements your insurance coverage and drives revenue straight to your bottom line.

Deliver Robust Protection

Your Customers Want from You

Securing policyholders’ most valuable assets is already part of your core mission. What about offering services that help protect their data and identity?

| The financial loss from identity fraud and scams was nearly $50 billion in one year alone.1 | |

| Consumers spent an average of 10 hours resolving fraud in 2023. In 2022, the average was 6 hours.2 | |

| 70% of consumers indicated they would likely purchase identity protection from their insurance company.3 |

In an industry – and world – that is heavily reliant on digital technology, your policyholders are increasingly at risk of data compromise and, worse, identity fraud. While insurance providers may offer identity fraud insurance policies, your customers are asking – nay, demanding – the tools they need to mitigate their risk.

Unclock New Revenue Streams

with Identity Protection from Iris

Iris’ premier offerings will help you fortify customer trust, strengthen retention and loyalty, and increase your company’s revenue. In fact, one of our insurance clients generated $18M in additional revenue from their identity protection program last year. What’s more, a major insurance client sees a 2% higher retention of policyholders with our identity protection services.

Enjoy Unmatched Flexibility

Across All Your Product Development Needs

Tech-Forward Solutions

Diverse

Experiences

Flexible

Enrollment

Data Management Options

Provide Your Customers In-Demand Protection

While Giving Your Brand a Competitive Edge

Stand out with world-class protection services, award-winning fraud resolution support, all-inclusive account management, and ongoing partner marketing assistance from Iris.

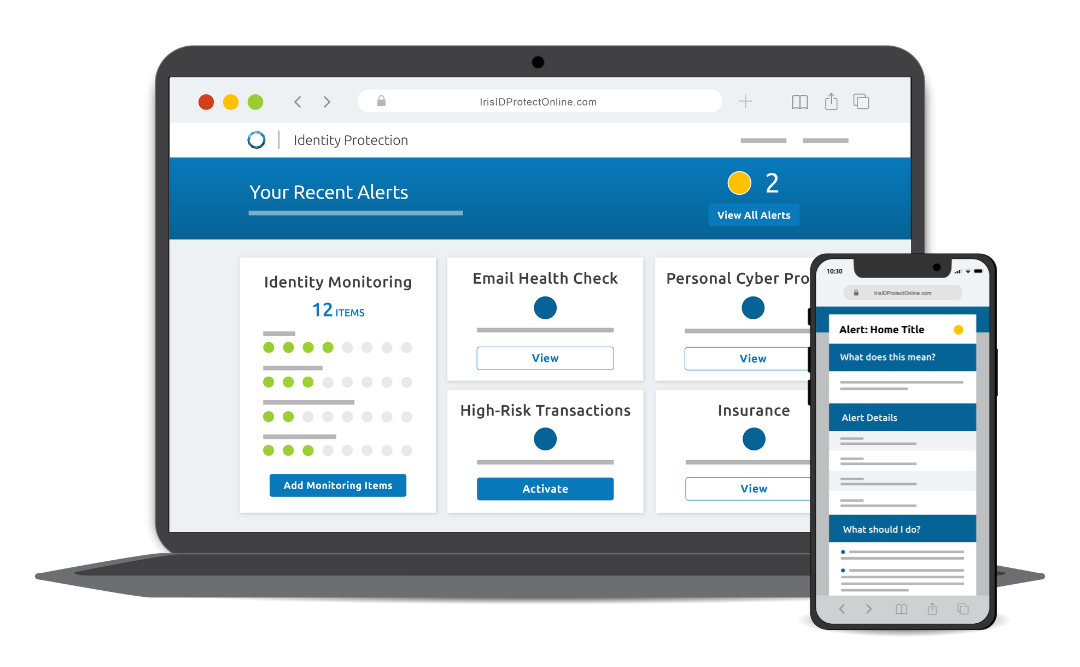

Check out some popular consumer protection solutions from Iris® Powered by Generali:

Credit Monitoring & Alerts

Identity Monitoring & Alerts

Home Title Monitoring & Alerts

High-Risk Transaction Monitoring & Alerts

Social Media Monitoring & Alerts

Caller ID Monitoring & Alerts

ScamAssist®

24/7/365 Resolution Services

Up to $3 Million ID Fraud Insurance

But wait. There’s more! Check out our full suite of available solutions.

World-Class Security from Iris

As an insurance provider, you know data security is of the utmost importance. Your customers’ trust in your brand to manage their assets and data is non-negotiable.

Iris meets the highest cybersecurity standards. In fact, security is ingrained into every level of our organization, making it one less detail for your company and your customers to worry about.

|

|

|

|

1. Javelin Strategy & Research, Identity Fraud Study, 2024

2. Javelin Strategy & Research, Identity Fraud Study, 2024

3. Iris Powered by Generali, Benenson Strategy Group, ID Theft & Cybercrime Research, 2022

*Iris® Powered by Generali is not responsible or liable for the availability, safety, accuracy, or effectiveness of the techniques, products, tools, or resources used by Iris Powered by Generali in its ScamAssist® service and customers’ access and use of ScamAssist is entirely at their own risk.

**Localized support based on partners’ region. For example, U.S. partners’ customers have access to U.S.-based Resolution Specialists.

***Iris offers a variety of Identity Fraud Insurance plans. All plans include up to $1 million in Identity Fraud Expense Reimbursement and Cash Recovery for unauthorized electronic fund transfers from Checking & Savings Accounts or Investment/Health Savings Accounts. Iris also offers an option for upgraded Identity Fraud Insurance with up to $2 million coverage, Home Title Identity Theft Expense Reimbursement, and Cyber Extortion Expense Reimbursement.

Identity Fraud - Expense Reimbursement, Cash Recovery Aggregate, and Investment & HSA Cash Recovery benefits are underwritten and administered by American Bankers Insurance Company of Florida, an Assurant® company, under group or blanket policies issued to Iris® Powered by Generali for the benefit of its Members. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits at https://www.irisidentityprotection.com/terms-conditions.

.png?width=102&height=102&name=Iris-Generali-Logo-White%20(1).png)