The 21st century American workforce is very diverse with a wide variety of lifestyles. There are more women in the workforce than ever before, careers are lasting longer, and non-traditional family structures are increasingly common. And today’s employees want to offered the best benefits to meet their diverse needs and lifestyles. According to MetLife’s 15th Annual U.S. Employee Benefit Trends Study, 58% of employees want customized benefits options.

In addition to a diverse workforce, work looks very different thanks to technology. There’s no longer a clear separation between work and life as people become more connected via their mobile devices. As a result, employees desire more than ever to find happiness at work. People are more willing to change jobs and take risks to find satisfaction at work. If employees can find stability and protection from the employers they trust, and safeguard against disruption in their lives from work, they’re more likely to stay loyal to the organization. Therefore, employers need to keep up with the ever-changing trends and provide the best benefits to meet their employees changing needs by investing in employee engagement and expanding their benefits package to include a variety of relevant, value-added services.

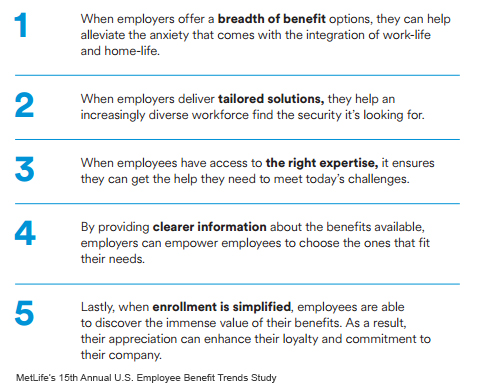

Expanding the definition of benefits—to include services that help protect employees both now and in the future—will enable employers to tackle today’s shifting workforce challenges. Offering a comprehensive benefits package shows employees that their employer is serious about meeting their needs and keeping them satisfied in order to lessen frequent job changes. Employees stated that customized benefit experiences have a significant weight when deciding to accept an offer or stay with their current employer. Consider the following strategies when developing a benefits package that would provide a wider range of options and meet employees’ ever-changing needs:

In addition to the strategies listed, the best benefits package should have a holistic approach. According to the study mentioned above, 74% of employees state that they gain peace of mind by achieving financial wellbeing through benefits. Be proactive by offering services that address this need. In 2016, over $16 billion were stolen from 15.4 million identity fraud victims. And according to a survey from Ponemon Institute, an average-sized company (with 10,000 employees) spends $3.7 million a year dealing with phishing attacks, and their annual productivity loss averages $1,819,923 as a result. Offer identity protection services during your next open enrollment period to prevent your employees from becoming a victim of identity theft. It will help employees stay safe and help retain them.

An identity protection service from a provider that values employees’ identities as much as they do, can change their lives. The peace of mind that comes with knowing their identities are protected is hard to match, especially in today’s interconnected world. Generali Global Assistance identity protection offers the comfort employees are looking for. Our vast library of resources will also allow employees to become proactive, knowledgeable consumers, ultimately making them less vulnerable to becoming victims of identity theft in the first place. And if they do fall victim to this crime, they can rest assured that our award-winning resolution team will be there 24/7 to help them recover their identity and assets.

To provide employees with security that allows them to stay focused on the job and better relax outside of it, request a demo of our identity and digital protection and services.

.png?width=102&height=102&name=Iris-Generali-Logo-White%20(1).png)